You’ve got to be confused.

One minute, I’m telling you to invest as much money as you can because stocks will rise. The next minute, I’m telling you that an economic collapse is inevitable. Then I tell you why you shouldn’t be overly optimistic about stocks and now I’m going to tell you why you shouldn’t buy or sell stocks.

What are you supposed to think? What are you supposed to do?

Well, there are thousands of reasons why people should invest in stocks and thousands of reasons why people shouldn’t invest in stocks. But, 2 “reasons” that I have heard recently are actually irrelevant and should not determine whether or not you invest in stocks.

Reason # 1 – Price

Price, by itself, is meaningless. Yet I continue to see investors use PRICE (and only price) as a reason to buy (or not to buy) a stock. Consumers and investors have a tendency to flock towards things that look cheap. As an example, let’s compare Facebook (FB) to Apple (APPL).

At first glance, it looks like Facebook ($28/share) is “cheaper” than Apple ($437/share). But is it really?

When you compare the PRICE to EARNINGS (P/E Ratio), you’ll find that Apple sits at about 10 and Facebook is hovering around 1900. Giggity, giggity. Which one looks more expensive now?

If price (alone) had any significance, I highly doubt Berkshire Hathaway (at $155,000/share) would get so much love.

Reason # 2 – All-Time Highs

The S&P 500 Index and the Dow have been buzzing around their all-time highs and the CNBC Cheerleaders are letting you hear about. Some people are looking at the all-time high as a buying opportunity (things are looking up!) while others are looking at it as a selling opportunity (overpriced bubble?). But, much like I said about PRICE by itself, the fact that we’re at all-time highs should not influence your investment decisions.

Think about this…if the stock market (like real estate prices, zing!) historically rises over time, then aren’t we constantly going to see all-time highs?

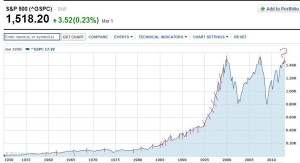

Look at this graph of the S&P 500 Index since 1950. I scribbled a line at random points of historical highs.

If you chose not to buy stocks in the 1970’s, 1980’s or 1990’s because we were at all-time highs, you would’ve missed out on a lot of gains.

So What Should You Do?

If you want to buy, buy. If you want to sell, sell. But don’t buy based solely on price and don’t sell because we’re at all-time highs.

[…] Your Day Job, PK points out it is 12% below its historical high if you adjust for inflation. Not a reason to sell, according to A Blinkin from Funancials. Barb also weighs in on what you should do when the market […]