By: Tali Wee of Zillow

Prospective homebuyers have tons of details to consider before deciding whether to purchase a home. It can become overwhelming to make such an expensive decision without extensive knowledge about the real estate industry or thorough understanding of mortgage rates, home values and the current market. After seeing headlines about underwater homeowners and record-breaking low interest rates, it can be difficult to judge when it’s a smart time to buy a home.

History of Home Values and Interest Rates

Making an educated decision requires home shoppers to strengthen their foundational knowledge of the marketplace. Numerous homeowners faced foreclosure after the real estate market crashed in 2006, due to inflated home prices, risky loans offered to unstable borrowers and lack of regulation on nontraditional loan programs. Few buyers emerged to purchase those homes for fear of continued depreciation. In 2012, the Federal Reserve reduced interest rates to jumpstart the market, making it more affordable for borrowers to acquire loans.

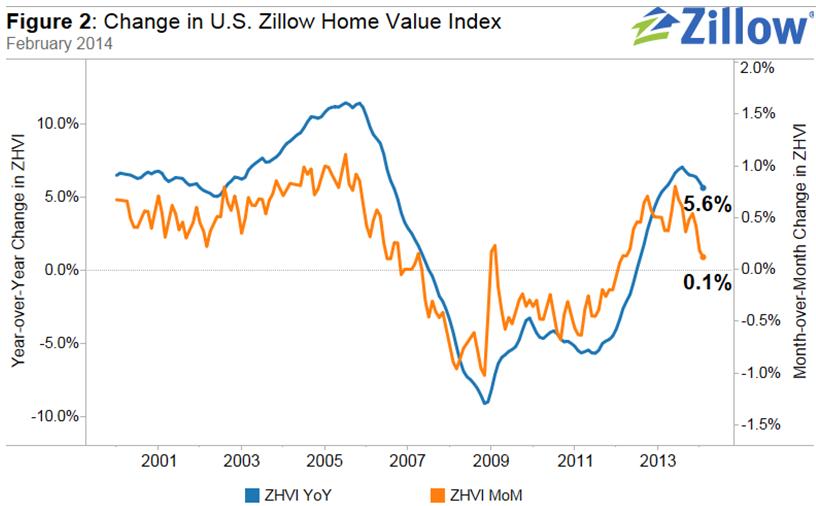

With low-cost inventory and inexpensive interest rates, both buyers and investors began purchasing homes competitively. According to Zillow’s latest Real Estate Market Reports, home values in the U.S. rose 5.6 percent throughout the past year. National home values are only 13.8 percent below their height in 2007.

More homeowners are beginning to sell their properties because home values recovered, which increases inventory. Interest rates also raised slightly, reducing investor participation. High supply and lower demand creates fewer bidding wars, which stabilizes home values. From January 2014 to February 2014, home values rose nationally only 0.1 percent to $169,200. Throughout the next year, Zillow forecasts a reduced appreciation of 3 percent. This slowed appreciation rate is more in line with historically sustainable levels.

The Zillow Home Value Index in Charlotte, N.C., is $148,000. Home values in Charlotte are forecasted to appreciate 2.3 percent annually, a more stable appreciation rate compared to last year’s 5.5 percent year-over-year growth.

Indicators of When to Buy

Although investing is always a gamble, buyers should feel confident that interest rates are likely as low as they will be for years to come and home prices are recovered but not unrealistically inflated. Since the market indicates it is a good time to purchase real estate, buyers must evaluate their own finances and future plans to measure if it’s a smart time to buy.

The best time to purchase a home is when it’s affordable for the buyer. Prospective buyers should evaluate their budgets to identify their fixed expenditures and gauge their disposable income. When budgeting, homebuyers should calculate the mortgage, taxes and insurance of their ideal properties. These costs should not exceed 25 to 28 percent of the buyer’s monthly income. The buyer’s debt-to-income ratio (DTI) should not surpass 43 percent of the monthly income. DTI includes all monthly expenses such as mortgage, taxes, insurance, minimum credit card payments, utilities and other cable/internet bills. These affordability guidelines don’t account for property maintenance which can cost the homeowner 1 to 4 percent of the total value of the home annually.

Additionally, buyers should consider how long they plan to live in their new homes. Short-term residents might opt to rent instead of buy. Or, they may select nontraditional loans such as an adjustable rate mortgage to benefit the first few years of homeownership before selling. Long-term buyers might shop for lenders offering the lowest rates on fixed-rate mortgages. They may also plan to pay larger down payments or prepay their principals in the first few years to save on interest costs.

In Charlotte, homeowners should plan to own their homes for a minimum of three years to justify the costs of ownership over renting. The breakeven horizon (Q1 2013) is a great way to judge if it’s smart to buy a home in a particular neighborhood if the owner plans to relocate in a couple years.

Prospective buyers can decide if it’s the best time for them to buy a property after they take into consideration the current real estate market trends, their own budgets, debts and the amount of time they plan to own their homes. The current market is healthy, so buyers who are financially prepared to purchase a home and remain owners for at least a few years can feel confident that now is the right time to buy.