I always wanted to be a Financial Advisor. And then I became one and quickly realized that my dream wasn’t everything I thought it would be.

There were 3 things, in particular, that drove me nuts and ultimately led to my demise.

- Most people hate to think and talk about money. We spend more time adjusting our fantasy football lineups and planning our next vacation than we do thinking about our budgets and asset allocations.

- A Financial Advisor can’t do what’s best for his client AND maximize his own personal income. There are misaligned incentives.

- No matter how much you read, how much you learn or how hard you try – it doesn’t increase your probability of predicting what’s next in the markets.

The good news, though, is that I learned a f*ck-ton, which according to Google, is equal to 10 metric sh*t-loads. And I’m going to share 5 of those with you below.

#1 Think About Your Money in Buckets

If you find yourself overwhelmed with all of the things you “have to do” with your money, it may help to organize your to-do’s into 3 buckets:

- Yesterday (credit cards, car loans, etc.)

- Today/Tomorrow (checking, savings account)

- Future (401(k), 529 plan, etc.)

If you have credit card debt, medical bills or retail financing accounts (even if they’re 0%), stop reading about investing and shift your focus towards getting out of debt.

There’s no sense in thinking about the future while you’re still catching up from yesterday.

If you have student loans, car loans or low interest non-mortgage debt, I would recommend investing up to your employer’s match then shifting the focus back to the debt. Paying 5% in order to capture a 50-100% return is justifiable. But, paying 5% for a chance to earn 7% isn’t worth the risk.

Takeaway: Take care of yesterday, prepare for tomorrow and then plan for things that will happen in 10-40 years.

#2 Financial Independence is the New Retirement

Retirement, in it’s usual form, is underwhelming.

Most people work unfulfilling jobs with their eyes looking toward the weekend and the day they turn 65. In other words, they waste 70% of their time for ~40 years so they can eventually kick back and relax.

At age 65, the images of cruise ships and golfing in paradise that once filled their heads suddenly get replaced by daytime TV and crossword puzzles. Many retirees become so bored with their newfound freedom that they return to work – often to another unfulfilling job just to pass the time.

It’s depressing; but, your story doesn’t have to be.

There is now a movement of financially savvy folks who are attempting to leave the rat race and retire early.

F.I.R.E. – Financial Independence, Retire Early

They see investing for what it is in it’s simplest form: “money making money”

The more money your money makes, the less money you have to make. The less money you have to make, the less you have to work.

They look at every saved and invested dollar as “buying your freedom.” They have even been able to estimate when you’ll experience this freedom based on your savings rate.

For example, if you save half of your income, you can potentially retire in 17 years.

| Savings Rate | Working Years Until Retirement |

| 10 | 51 |

| 20 | 37 |

| 30 | 28 |

| 40 | 22 |

| 50 | 17 |

| 60 | 12.5 |

| 70 | 8.5 |

| 80 | 5.5 |

| 90 | 3 |

| 100 | 0 |

Assumptions:

- Starting from a net worth of $0

- You earn 5% investment returns after inflation during your savings years

- You live off of the 4% safe withdrawal rate after retirement

- You only live off the gains since we don’t know how long you’ll live

Remember, every dollar you spend on something pushes your retirement date out to some degree.

If you want to find out more about the F.I.R.E. movement, here are two pioneers at the forefront who offer unique and refreshing perspectives on life:

Takeaway: Make your money work, so you don’t have to.

#3 Focus on Systems, Not Goals

Goals are good, don’t get me wrong. But, they can sometimes seem so daunting that we ask ourselves “why even try?”

This is especially true when people try to calculate their retirement “number.”

The basic rule says that saving 25x your annual expenses should allow you to comfortably retire. So, if you spend $80,000 per year, that’s a whopping $2 Million that you’ll need to save.

This number may seem unreachable considering 46% of Americans can’t afford a $400 emergency.

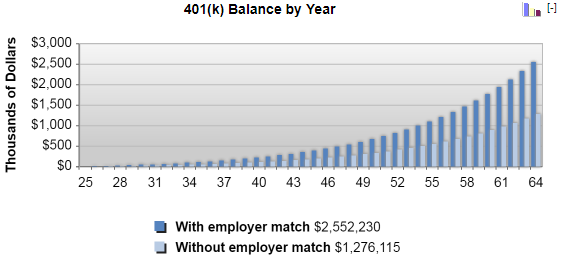

But, what if a 25-year contributes 5% of her paycheck into a 401(k) for 40 years?

Well, with annual salary increases and matched contributions, that 5% automated contribution gradually builds up to $2.5 Million.

Suddenly, the daunting seems doable.

Takeaway: People often overestimate what they can do in the near-term and underestimate what they can accomplish in the long-term.

#4 There’s a Difference Between Investing and Gambling

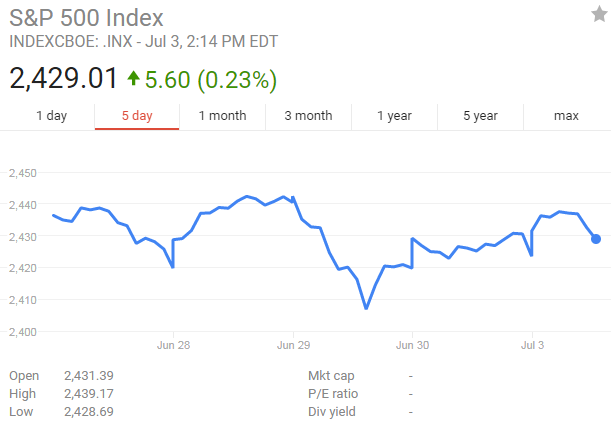

It’s almost as if there are two different stock markets.

There’s the short-term market which goes up and down like a roller-coaster:

And the long-term market which primarily goes up and to the right:

The short-term market is full of active traders who went to Ivy League schools and have devoted their lives to studying securities. They get paid a lot of money to closely follow a few companies within a few industries. They have close relationships with companies’ CEO’s and CFO’s in order to better understand what’s going on inside the company. This constant microscope and level of scrutiny leads to massive volatility day-in and day-out as companies report their earnings. If expectations were a penny higher, the stock could tank. If expectations were a penny lower, the stock could skyrocket.

The long-term market goes up over time as businesses continue to provide services that consumers want to spend money on. This market is self-cleansing because the companies that provide no value eventually go out of business while the companies that provide tremendous value grow to the sky. The neat thing about this fact is that the most a company can lose is 100%. But, companies often gain 300%, 500%, 1000%+. So, things are skewed to the upside.

It’s completely up to you on which market you choose to participate in.

But, it’s important to understand that one is an addictive form of gambling that typically leads to sudden losses while the other is the best proven way to build wealth.

Takeaway: Buy low, sell high never.

#5 You Get What You Don’t Pay For

In most situations, there’s a basic truth that we have all come to accept: “you get what you pay for.” I reminded myself of this after my wife and I celebrated the “gender reveal” of our little baby girl…who ended up being our little baby boy. Long story short: we got the ultrasound from a place we found on Groupon. In other words, we got what we paid for.

When it comes to investing, though, the exact opposite is true:

You get what you don’t pay for.

That is, what you don’t pay in fees (to financial advisers and investments) typically comes back to you in the form of higher returns on your money.

And, here’s another truth:

Not all Financial Advisors are created equally.

There are a wide-range of professionals who consider themselves “Financial Advisors” – all with varying levels of experience, education and areas of expertise. Here are some of the common titles you’ll find:

- Chartered Financial Analyst (CFA)

- Certified Public Accountant (CPA)

- Certified Financial Planner (CFP)

- Wealth Manager

- Investment Consultant

- Personal/Private Banker

- Insurance Agent/Broker

Regardless of their specialty or certification, the way most of these advisers make money can be grouped into 4 categories:

- Commission from the products they sell

- A percentage of “assets under management” (AUM)

- Flat fee for services

- Salary

Depending on how the Financial Advisor is paid (ie. commission), there may be a conflict of interest and misaligned incentives. In order for the adviser to maximize his or her personal income, they must recommend products that pay them the most. Products that pay them the most aren’t typically in your best interests (ie. whole life insurance).

Now, in fairness, a counter-argument can easily be made as your wealth grows and your investments become more complicated.

When I look around at the wealthiest people I know, they all have Financial Advisors. Do they have Financial Advisors because they’re wealthy or are they wealthy because they have Financial Advisors? Probably the former. But, it’s difficult to frown upon someone paying for financial advice while we simultaneously pay for people to cook for us, clean for us and mow our lawns. They’re all things we don’t feel like doing or don’t feel comfortable doing ourselves.

So, if the thought of managing your own investments is paralyzing then here are a few tips in finding an appropriate advisor:

- If you’re new to investing, check out Betterment

.

- Automated investing at a low cost (.25%) with simple, tax-efficient portfolios.

- If you have several accounts already or >$100k in investments, check out Personal Capital

.

- Free dashboard to view all your accounts, analyze fees and personalized advice for a slightly higher fee (.89%)

- Vanguard is always a good option as well. Easily the most preferred, investor-friendly company in the industry.

- If you find new technology intimidating and prefer to work with someone face to face, then you can check out anyone’s background ahead of time and which licenses they carry here: BrokerCheck

- Series 7 means they can sell you stocks. Series 6 means they’re limited to mutual funds and annuities.

- You’ll probably have to pay at least 1% for their advice. Make sure they’re worth it.

- Also, don’t listen to anyone that calls insurance an investment. Chances are they can only sell insurance.

To summarize, you can spend time learning about advisors, their expertise, how they’re paid, etc. or you can spend time learning about investments.

Takeaway: No one cares more about your stuff than you do.

[…] What I Learned Being a $hitty Financial Advisor — […]