Check out this window:

Question: What happens when a rock is thrown at this window?

Answer: The entire thing shatters.

Next, check out this window:

Question: What happens when a rock gets thrown at this window?

Answer: 1/4 of the window shatters.

Lastly, check out this window:

Question: Does this look more like a fly swatter than a window? For sure, but let’s pretend it doesn’t.

What happens when a rock is thrown at this window?

Answer: 1/64 of the window shatters which is hardly noticeable.

The point, which you may have already picked up on, is that:

We’re living during a time where there are a lot of freaking rocks.

We don’t know who will throw them or where they’ll come from, but it’s probably a good idea to build your house, windows, etc. in a way that minimizes the damage from things such as these rocks (or hail, rain, wind, lightning, etc.).

That’s enough of the window analogy, here’s:

A Real Life Example Illustrating the Importance of Diversification

Under Armour is a sexy company.

It’s difficult to go anywhere without seeing the giant UA staring back at you.

As a sports guy, it was impressive to see the best athletes in the world sporting their apparel:

- Michael Phelps (Olympics ‘MVP’)

- Steph Curry (NBA MVP)

- Tom Brady (NFL MVP)

- Cam Newton (NFL MVP)

- Bryce Harper (MLB MVP)

- Jordan Spieth (PGA ‘MVP’)

The UA logo also followed me into my MapMyRun app which was their investment in “connected fitness.”

Needless to say, I was bullish about the future of Under Armour…

…until yesterday.

I logged into my Personal Capital account to find that my Under Armour investment was down 23%. Ouch.

Here’s why it dropped:

- Lower than expected sales over the holiday and lower expectations for 2017

- The CFO announced that he’s leaving the company

- Stiff competition from companies offering “athleisure” apparel

- Retailers struggling in general (ie. Macy’s is closing stores and The Sports Authority filed for bankruptcy)

Now, as much as the drop hurt my ego, the impact to my overall portfolio was hardly noticeable – much like the rock going through the fly swatter multi-pane window.

That’s because I limit my investments in individual stocks to no more than 10% of my overall portfolio.

If you’re like me and want to gamble actively invest without completely wrecking your life, you should consider a similar approach and maintain at least a minimum level of diversification. If your primary goal is to minimize your risk, then you should consider a more diversified portfolio.

Here are a few to consider:

Various Levels of Diversified Portfolios

Minimum Level of Diversification for Someone Who Enjoys Trading Stocks:

- 90% S&P 500 Index Fund

- 10% Individual Stocks

Basic Level of Diversification for Someone Who Keeps Things Simple:

- 100 Minus Your Age as a % in Stocks (ie. 70%)

- Your Age as a % in Bonds (ie. 30%)

Next Level of Diversification for Sophisticated Investors:

- 20% Domestic Stocks

- 20% International Stocks

- 10% Emerging Stocks

- 20% Real Estate (REITs)

- 15% Long-Term Treasuries

- 15% TIPS

Maximum Level of Diversification for People Who are Really Scared to Lose Money:

- 30% Stocks

- 15% Short-Term Treasury Bonds

- 40% Long-Term Treasury Bonds

- 7.5% Gold

- 7.5% Commodities

As you surf through these sample portfolios, it’s important to keep in mind that the point of diversification is to maximize returns with the least amount of risk.

Now, It’s Time to Take Action

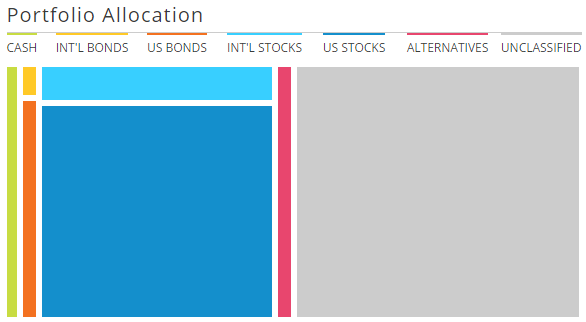

If you’re not sure how your money is invested, then I recommend signing up for Personal Capital (it’s free) which will sync all of your accounts (savings, 401k, IRA, etc.) into one dashboard and show your overall allocation.

If you notice that you’re invested too heavily in one asset class, consider a more diversified approach.

In Summary,

- Windows

- Rocks

- Under Armour

- Rule of 100

- All Weather

- Personal Capital

Got it?