When you consider your personal finance strategy, it is always a good idea to keep diversity in mind. You may have heard the term "diversified investments" before without really giving it any thought, but in fact adhering to a strategy of diversity can be extremely financially beneficial. The basic …

What Causes Inflation?

Sometimes I wish that inflation were a tangible thing so that people would pay more attention to it. Could you imagine the outrage caused by someone stealing money from you every day? I think we would all do whatever it took to prevent this thievery from happening. If we were to dress up this …

How To Dominate The Dow

I spend too many hours each day scouring the internet for various articles pertaining to personal finance and the economy. Yahoo! Finance often assists by aggregating useful information for me. It is the useless information, however, that has inspired me today. In the article Cliff May Knock Out …

How Are You Affected by the Mortgage Interest Tax Deduction?

This is a heavy subject that deserves a lot of discussion. I, unfortunately, have the attention span of a 3rd grader surrounded by Legos so an abbreviated analysis will have to do. The History Interest deductions, in general, began in 1913. At this time, the majority of Americans paid upfront …

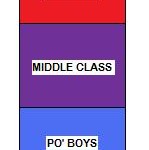

The Middle Class Squeeze

"Everyone wants to believe they are middle class...But this eagerness...has led the definition to be stretched like a bungee cord — used to defend/attack/describe everything...The Drum Major Institute...places the range for middle class at individuals making between $25,000 and $100,000 a year. Ah …

Who Do You Listen To?

Information is so accessible nowadays; there's no excuse for "not knowing something." A simple Google search on your Smartphone will end any debate and answer any question you could ask. Unfortunately, not all information is created equal. Some is accurate, but most is misleading. Because …

“Doing Nothing” is a Decision (and the riskiest one at that!)

What would you do if I told you that Ally Bank or ING Direct were offering an awesome *NEW* account? What are the awesome terms, you ask? (- 2%) Regardless of how much you put into this new account, you're guaranteed to lose 2% each year. Who, on Earth, would invest their money in such an …