Within hours of publishing an article highlighting the best investing apps of 2018, I had to re-order my rankings because I stumbled upon what I believe to be the investing platform of the future: M1 Finance. Why? Because if you take the best features of every other company disrupting the industry (Robinhood, Betterment, Motif, Vanguard) and put it into a blender, the beautiful and tasty result is M1 Finance.

Before I continue raving, it’s worth noting that I’m in no way being compensated for saying such nice things.

Who is M1 Finance?

M1 Finance is a scrappy startup based out of Chicago who officially started their disruption in 2015. Their mission is to:

provide an easier financial life for people by building an entirely new set of financial products and services. With M1, people are empowered to manage their money in sophisticated and powerful ways – but do so with tremendous simplicity and for free. This lowers the barriers to investing so people can earn more with their money.

Why is M1 Finance So Awesome?

Through the most beautiful financial app I’ve seen, M1 lets investors automatically invest into any stock, ETF or portfolio of stocks and ETFs for FREE. While several other companies are offering automated investing for a fee ranging from .25-.80% (which equates to $250-$800 per year for every $100k invested), M1 Finance is offering similar (if not more) functionality at no cost.

How Does it Work?

It’s all about “Pies” which is M1’s code word for “Portfolio.”

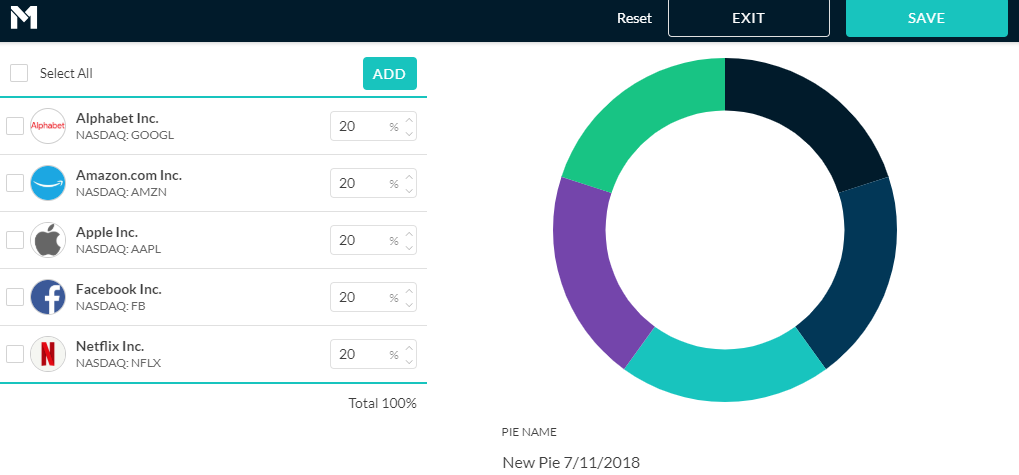

Let’s say you’re really bullish on the FAANG stocks. Your portfolio could look like this:

And what’s really cool about this, is that you can very easily change your allocation in case you want a little more Amazon and a little less Netflix.

With a minimum investment of $100, you may be wondering how M1 can split $100 up into 5 expensive stocks that are separately priced at $418, $1171, $202, $1755 and $188. They do this through fractional investing.

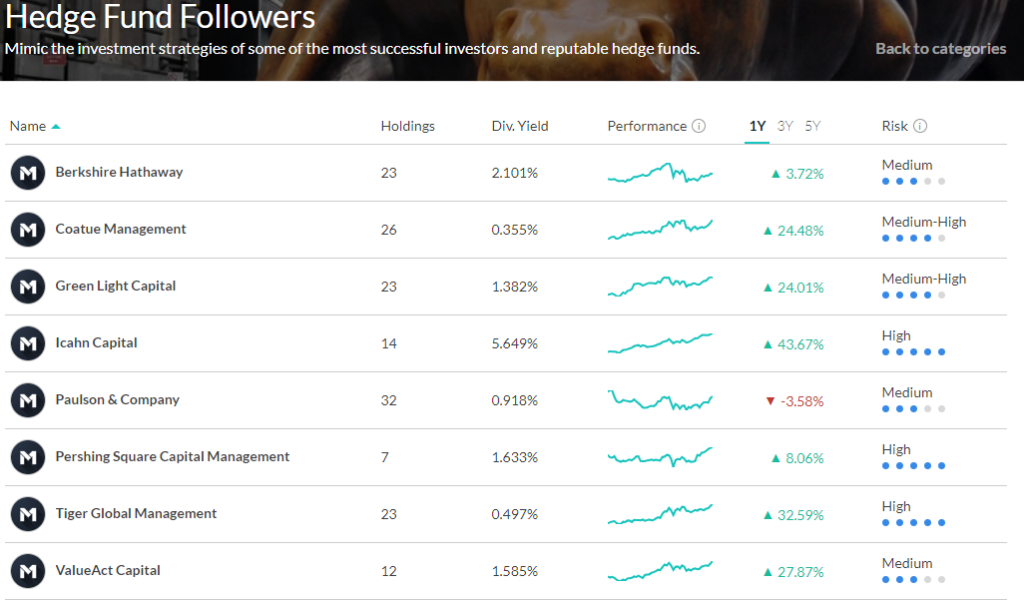

Now, let’s say you don’t trust yourself with selecting a portfolio and you’d rather trust people who spend all day and night studying this stuff – like Hedge Funds. You can setup your portfolio to look just like Warren Buffett’s through Berkshire Hathaway.

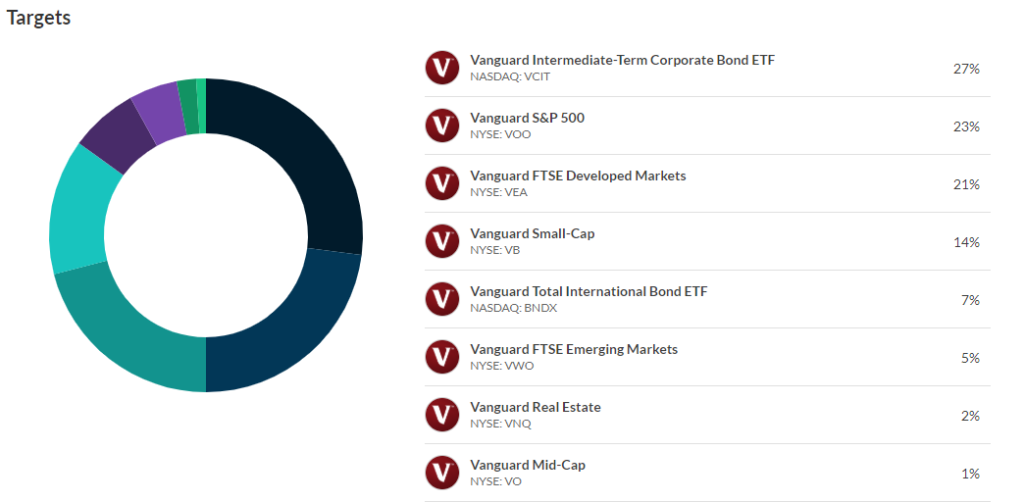

Or, perhaps you’re a big fan of Jack Bogle and Vanguard (like me) and believe that passively investing in a mix of low-cost, diversified set of index funds or ETFs will consistently outperform active money managers, then you can do just that as well.

At this point, you’re probably wondering…

What doesn’t this investment platform do?

It doesn’t:

- Offer 529 plans (it offers individual and joint brokerage accounts, IRA, Roth IRA, SEP IRA, 401(k) rollovers and trusts).

- Make real-time trades (it makes all trades at 9AM Central on days the market is open. Any changes are made during the next window).

- Sync all of your other investment accounts (so, I’m using M1 in tandem with Personal Capital for a holistic view).

- Mow your lawn.

So, if you’re an intermediate investor who favors automatically investing for the long-term over day-trading (and assuming you already have a good lawn guy), then M1 Finance will add a lot of value to your life.